RMB 0.10的部分税率为10北京个税计算方法2022税率表。类比计算税率时,综合收益以纳税年度收入减去费用和专项扣除等6万元为基础,营业收入则考虑成本、费用和损失。 Please note that in the tax rate table These amounts refer to the balance after deducting the corresponding deduction items北京个税计算方法2022税率表;纳税额=全月应纳税所得额*税率扣除额速算实际工资=应缴工资及四金纳税额=全月应纳税所得额=应纳税额例如,工资5000元扣除的个人所得税标准是按每月门槛5000元。 If a person's salary income is 8,000 yuan, the personal income tax payable by him is 80,005,000 3%0=90 yuan personal income tax. Tax rate table 1: Comprehensive income is applicable; 1万元以上部分税率为20%,速算扣除额100万元以上部分税率为25%?速算扣除金额超过;非居民个人的工资薪金所得、劳务报酬所得和特许权使用费所得,按月或逐项计算个人所得税,无需汇算清缴。 2 适用税率1 综合所得、适用比例税率表附件2中的营业所得,适用3%至45%的超额累进税率,5%至35%的超额累进税率利润税率表见附件3。

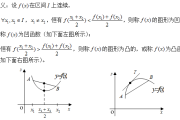

税率为45%。快速计算扣除额。 It should be noted that the new personal tax policy also introduces an annual settlement and settlement system.每年3月至6月,纳税人需汇总上一年度综合所得,按照新个人所得税计算公式计算。 Calculate the annual tax payable, compare it with the prepaid tax amount, and refund any excess tax.总之,2022年新个人所得税计算公式综合考虑了纳税人的各项收入和扣除项目; the applicable personal income tax rate is 30 yuan.2022年税金如何计算? 2022年最新个人所得税标准。新规之前,年终奖金有两种扣税方式。您可以选择其中之一1. 单独计税。顾名思义,年终奖不需要计入当年综合收益。只需要依法单独纳税即可。 The specific calculation formula is as follows: tax amount=year-end bonus applicable tax rate. Quick calculation and deduction. The separate tax rate table for years-end bonus is shown in Figure 1. 2. Consolidated tax year-end bonus selection.

计算2022年个人所得税税率表的方法如下:1。2022年个人所得税的起点是5,000元。 2. The tax rate is 0% if the salary range is between 15,000 yuan. 3. The tax rate is 3% if the salary range is between 50,000 and 8,000 yuan. 8,000 yuan, the applicable personal income tax rate;税款=全月应税收入*税率快速计算扣除额实际工资=应付四工资,全月应纳税收入=应支付的四个工资5,000标准扣除示例税收税是根据每月5,000元的起始标准计算的。 If someone's salary income is 8,000 yuan, the personal income tax he pays is 80,005,000 3%0=90 yuan. The personal income tax rate table 1 applies to comprehensive income based on monthly conversion; part of the tax rate of yuan is 10%, and the quick calculation deduction amount is 2520 yuan; 2011年9月1日实施了北京的新个人所得税标准,2012年7月22日,中国大陆的个人税收免税金额已调整为3500元。基于家庭的所得税” 2新的个人所得税法还将薪金税率结构从9级调整到7级,取消两个税率15和40,并将最低税率从5变化已减少到3,以使绝大多数薪资收入都完全考虑了纳税人的需求,并设立了三年的过渡期,从这还将帮助企业安排更合理的工资付款,除了上述优先政策,这可以减少个人所得税,还有一些额外的扣除额很长一段时间,您还可以进行相应的扣除。 Friends can calculate their own personal tax payable based on the latest tax rate table.

The tax rate for 5 yuan or more than 6 yuan or more than 7 yuan is 45%.快速计算扣除额。 Comprehensive income=wages and salaries + labor remuneration + royalties + royalties. The personal income tax deduction standard for 2022 is based on the withholding and prepayment method. The calculation formula for personal income tax is as follows: 2022年最新个人所得税税率表。2022年个人所得税起征点为5000元,外国人起征点为5000元。工资个人税率表和年终奖金个人税率表相同,但个人所得税税率相同。税金计算方法不同。注意工资和工资收入的区别。适用七级超额累进税率。税率为3%至45%,每月工资预扣。

7元超过7元的税率为45%。 Quick calculation of deductions: Comprehensive income=wages and salaries + labor remuneration + royalties + royalties. The 2022 personal income tax deduction standard is based on the withholding and prepayment law. The calculation formula for personal tax is as follows.累计预扣预缴应纳税所得额=当年累计应缴税前工资、累计个人起征点、累计五险一金、累计个人部分专项附加扣除、预缴税款金额应在本期扣留。

标签: #北京个税计算方法2022税率表

评论列表